Financial habits

What are financial habits?

Financial habits are the routine practices that you put in place in order to navigate your day to day financial lives. The benefit of having financial habits is that you are able to manage your money effectively and it also enables you to make quick financial decisions as well as handle any financial challenges sufficiently. Do you have any financial habits?

Financial habits for people who want to start saving

There are many good financial habits you can add to your life as a daily routine, if you’re one of those people who want to start saving money. For example, start by keeping your savings separate from your spending money. You can put this into practice by opening up a savings account, this will help you keep your money for bills and other purchases separate to money you have kept aside for savings therefore, you will not be overspending or you won’t be tempted to spend your savings money if it is in an account.

Cash savings in the UK

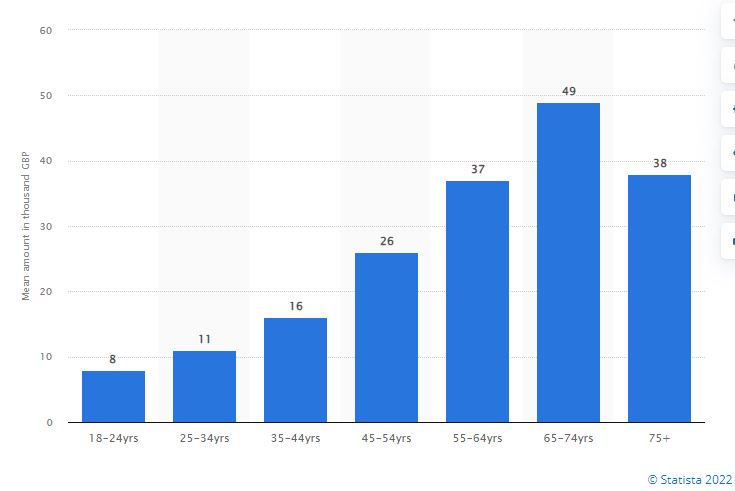

During 2017 in the United Kingdom, research shows that 6.5 million adults had no cash savings. The bar graph provided in the resource also shows that between the age of 18 to 24 years old, they had the lowest mean amount in cash savings out of all the age groups. The resource provided also shows that younger people put their money towards spending more than saving whereas older people put a lot more money towards savings which proves that wisdom comes with age. The bar graph shows that people over the age of 65 have a higher mean amount of cash savings compared to people who are younger.

Savings account in America

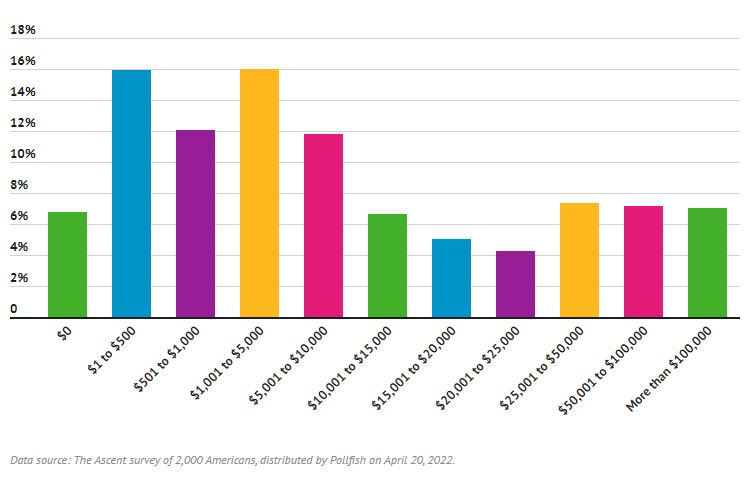

(2022) Another source shows that 78% of Americans have a savings account.Roughly 22% of Americans have $1,000 to $5,000 in their savings account, 51% have $5,000 or less in their savings account and 35% have $1,000 or less in their savings. The median savings amount for Americans according to this resource is $4,500. At Least 53% of Americans with a savings account have more than one account, this shows that Americans have a good financial habit of saving their money and keeping their spending money separate from their savings.

Setting a budget

Another financial habit which will help you start saving is by setting yourself a budget. By doing this, you can view where you can save loads of money. Setting a budget enables you to set yourself a limit on how much you spend on different things such as household shopping or even shopping for yourself. This financial habit will help stop you from overspending as well and make you question whether you really need something or not, allowing you to save loads of money.

Budget plans in Canada

Resource tells us that only 47% of Canadians use a budget plan for their spendings. They do this by adding up their income, estimate their monthly expenses and then figure out their differences by subtracting their expense total income from their income total. This can help them with covering any costs for unexpected emergencies, pay bills on time or even help them reach their financial goals.

Budgeting before and after covid

A different resource tells us that the percentage of adults that prepare a budget is 86%. This percentage was between the years 2021 and 2020. During 2018 and 2019 before the pandemic, the percentage of adults that prepare a budget was roughly 70 percent according to the resource used. This shows that before the pandemic, the economy was doing well and people weren’t that concerned about saving money as jobs were still available and people weren’t getting their jobs taken from them. After the pandemic people may have realised that it has had a massive impact on the economy, which is making it harder for people to keep any money as they have spent a lot of it and jobs are being taken from people due to the fall in the economy so it is very important to have money saved aside for emergencies such as another pandemic.

The importance of having financial habits

There are many different types of financial habits you can add to your day to day lives in order to help you control and manage your money and understand what to do during financial situations. It is important to put these financial habits to use as it can help you with many things such as preparing yourself or saving yourself from financial risks, allowing you to invest more than spend more and help you plan your future needs as well as evaluate them effectively and make good decisions. Will you start putting good financial habits to use in your life?

Paying back debts on time

A really healthy financial habit is paying back your debts on time, as this can help bring many benefits. For example, by paying them back on time, you are able to improve your credit score. What is a credit score? A credit score is a 3 digit number which will show you what your chances are of being accepted for credit. If your credit score is high, then you have a higher chance of being accepted for any credit applications.Therefore, you can successfully apply for loans etc. Your credit score will be based on your credit report. By paying debts back on time, you are able to start saving again and focus on any financial goals you may have.

Prillionaires App and your financial habits

Not sure on how to keep track of your net worth? With our Prillionaires app you are able to track your net worth with ease, by using our net worth calculator feature. With our app you are also able to transfer money, view statements, track investments, view reports and much more. The main functionalities of the Prillionaires app includes money management, wealth management and multiple online banking which is very beneficial for helping you with putting healthy financial habits to use in your daily life. The app is very easy to use which means customer service isn’t required. If you need support with putting your financial habits to use in your day to day life as well as support with tracking your net worth then start using the Prillionaires app to help.