Manage all your wealth in one app

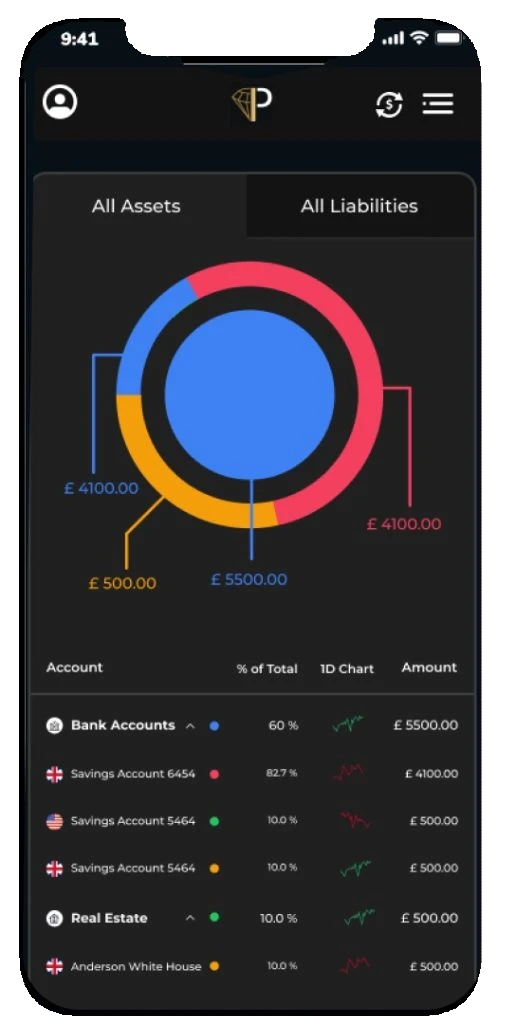

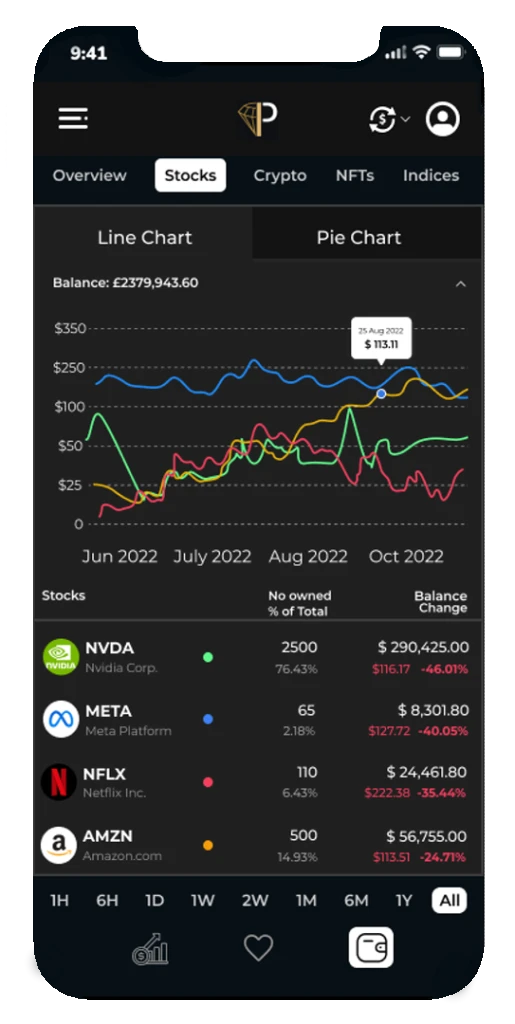

The Prillionaires app represents the next generation of wealth management and personal finance software, facilitating real-time money management and secure multi-banking functionality all in one place. Users can manage and track investment portfolios, analyze market trends, monitor asset values, and utilize a net worth calculator.

Bank level security

Enjoy peace of mind with a protected and secure encrypted wealth management account, empowering new ways to access your financial institutions. Open banking, trusted by over 14.4 million US users, is regulated to ensure safety and transparency.

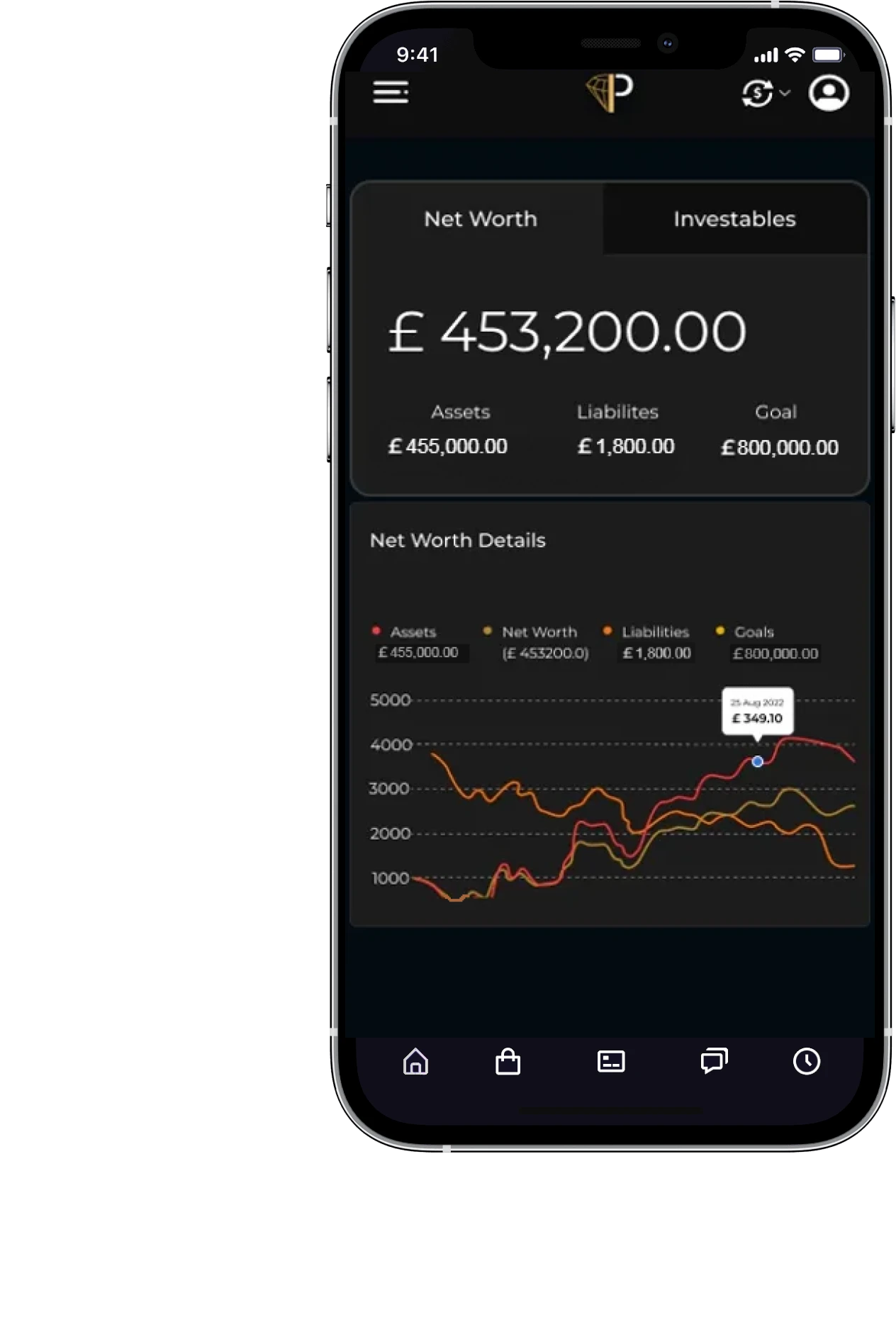

Net worth calculator

Prillionaires personal finance software is crafted to assist in assessing your financial position by estimating your net wealth. We gather comprehensive information regarding your assets and liabilities, provide up-to-date valuations of your property and vehicles, and automatically track your total net worth.

Wealth management app & Personal finance software

Who wants to be a Prillionaire ?

A prillionaire has multiple bank accounts, savings, loans, credit cards, retirement accounts, properties, car, stock and even different crypto wallets. Or they might not have them all yet, but they want a consolidated overview of their wealth from all over the place, in less than two minutes and they would like to track their total net worth.

Prillionaires Making Headlines

About Prillionaires Wealth management App

Don't have the time or resources to meet with a financial advisor in person? Discover Prillionaires, the top-rated personal finance software boasting bank-level security in the United States. With Prillionaires, managing multiple bank accounts, monitoring your financial assets and liabilities, and calculating your net worth has never been easier. Our user-friendly app also features multi-currency functionality and is accessible on both desktop and mobile devices, providing the flexibility to manage your finances on-the-go.

Multiple Online Banking

Wealth Management

Money Management

Net Worth Calculator

Prillionaires App's Stand-Out Features

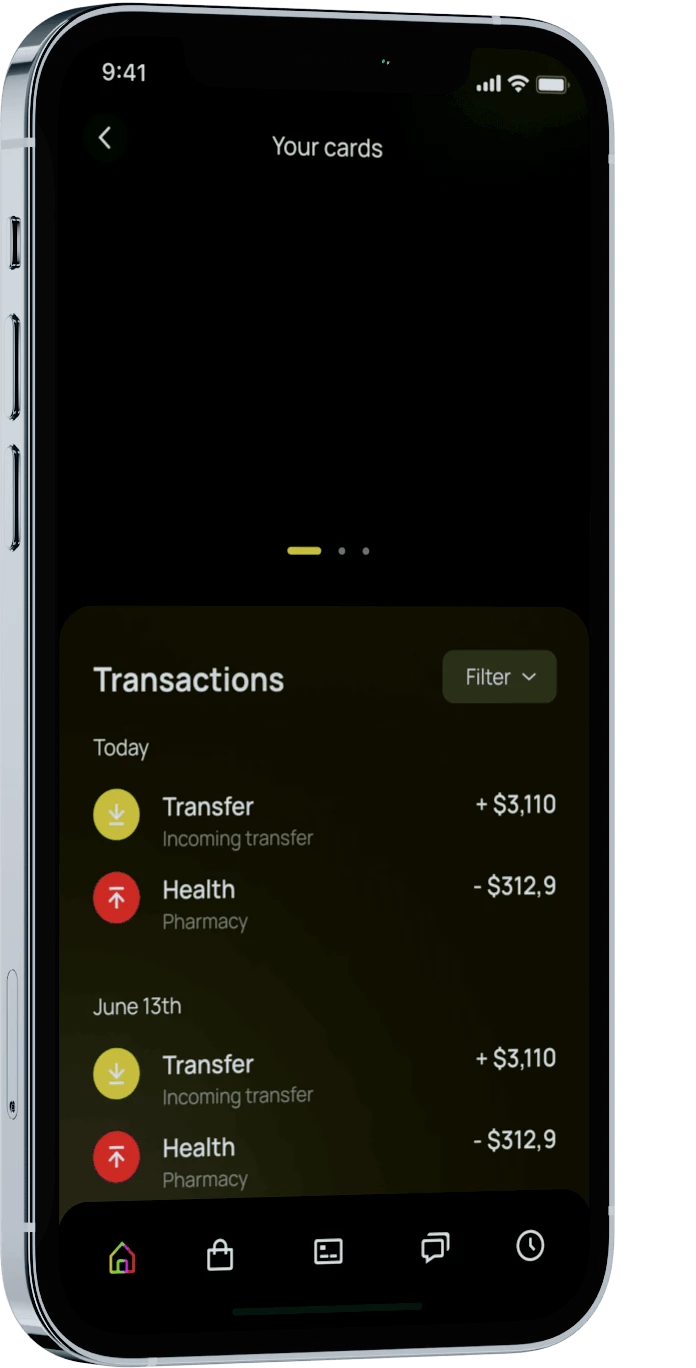

Manage all bank accounts from every country

Multiple banking: You can generate reports for transaction statistics and export them as csv files prillionaires wealth management app provides you a transparent overview of all your linked monetary accounts as clear breakdowns of your month-to-month bills

Track investments and brokerage accounts

Savings overview: Manage your investments accounts choosing from – standard brokerage accounts retirement accounts schooling accounts among others add and monitor your loans credit cards and investment products in a single place

Add your cryptocurrency wallet

Multiple wallets: Add and manage your multiple crypto wallets and your multi-currency wallet with the portfolio tracker in one single place. Monitor your Ledger Nano S Ledger Blue Coinomi Trezor Freewallet Exodus Guarda Atomic wallet Coinpayments and more.

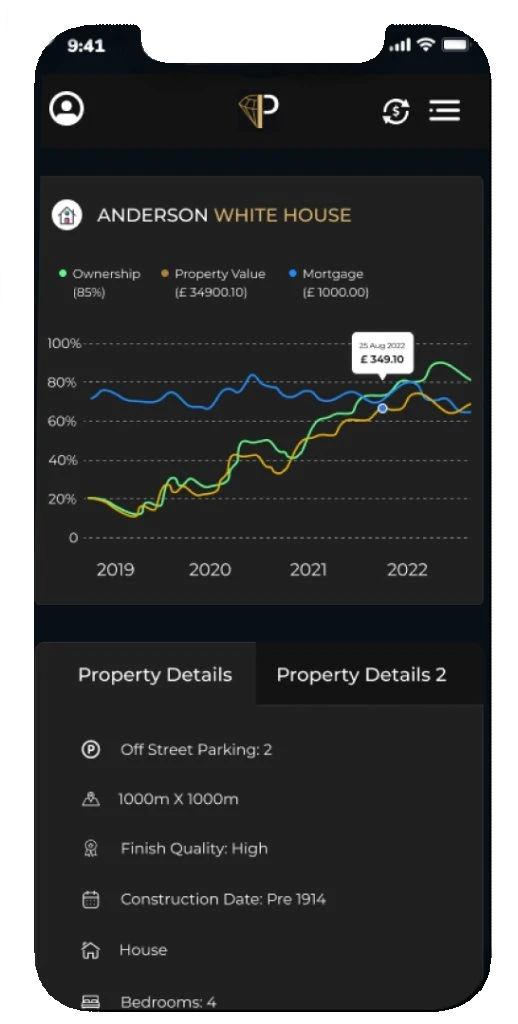

Monitor your properties and cars valuation

Net worth tracker: Unlock your future with digital wealth management. Transparent picture of your own assets and liabilities. Our wealth management app allows you to monitor the value of your property or car with the app’s net worth calculator.

Money management

By prioritising money management you can lower your costs. You are more likely to be able to keep track of your monthly outgoings avoid hidden fees and charges and invest extras wisely. With Prillionaires Wealth Management software you can perfect your approach to money management and improve your financial success.

Clients are Loving Our App

I used to dread managing my bank accounts and cards but the Prillionaires wealth management app has made it easy. No more multiple logins in different applications, Citibank Bank of America and Ally. I especially love check my net worth, which gives me a clear picture of my family’s wealth. Highly recommended!

Sarah L.

MarketingI've always been a tech geek, but Prillionaires took my love for technology to a new level. Its intuitive design and real-time tracking of my various investments, including my crypto assets, have made financial management a breeze and almost fun! The future of personal finance app is here, and it's Prillionaires.

Mark T.

QA EngineerAs a busy mom juggling work and home, the Prillionaires personal finance software has been a godsend. The Multiple Banking feature lets me handle all my accounts in one place, saving precious time. This money management app doesn't just manage my finances; it manages my peace of mind.

Jessica B.

IllustratorI am one of the very early users of Prillionaires, and it has truly changed the way I approach my finances. With their property tracer, I have an up-to-date real estate portfolio value calculated in US Dollars, although not all houses are in America. I feel more confident about my financial future. Thank you, Prillionaires!

Michael P.

PR DirectorI have been using Prillionaires for a few months now, and I can't imagine going back to my old methods. Say goodbye to the Excel sheet; this app is a game-changer! Now, I am testing its portfolio tracker, and I was able to link my retirement account, brokerage, and crypto accounts. I can see the account balances in real-time, and there is a nice balance history graph where I can follow the growth. This is going to be a top-rated app soon!

Robert Mc. G.

Risk ManagerSIGN UP FOR OUR WAITING LIST TODAY!

Join the growing number of satisfied Prillionaires customer across the United States who trust Prillionaires to help them achieve their financial goals. Be the early adopter and get a head start with our cutting-edge application.

Any questions?

Check out the FAQs

Still have unanswered questions and need to get in touch?

PRILLIONAIRES HAVE 2 DEFINITIONS:

Definition 1: The group of people; who have multiple bank accounts, savings, loans, credit cards, retirement accounts, properties, cars, stocks, and even different crypto wallets. Or they might not have them all yet, but they want a consolidated overview of their wealth from all over the place, in less than two minutes, and they would like to track their total net worth.

Definition 2. The App; Prillionaires is a money management and wealth tracker app, it is able to organise your multiple assets and liabilities across borders, and calculate and track your total net worth.

Personal finance management software is a tool that helps individuals and households manage their finances by providing a comprehensive platform for budgeting, expense tracking, investment management, and financial planning. The software integrates all of your financial accounts, such as bank accounts, credit cards, and investment accounts, into one centralized platform, making it easier to track your spending, monitor your budget, and plan your finances effectively.

Based on the most recent data available (2022-2023), the following bar chart illustrates the usage of fintech apps by age among Americans.

| Age Group | Percentage of Americans Who Use Fintech Apps |

|---|---|

| 18-24 | 72% |

| 25-34 | 84% |

| 35-44 | 68% |

| 45-54 | 56% |

| 55-64 | 41% |

| 65+ | 23% |

This data was sourced from a survey conducted by the consulting firm Cornerstone Advisors in 2023. As you can see, younger Americans are much more likely to use fintech apps than older generations, with 84% of those between the ages of 25 and 34 using fintech apps compared to just 23% of those aged 65 and over.

Based on data from a survey conducted by the National Foundation for Credit Counseling (NFCC) in 2022-2023, the following is the bar chart that visualizes the financial literacy levels of Americans based on education:

| Education Level | Financial Literacy Level (Percentage) |

|---|---|

| High school or less | 39% |

| Some college | 47% |

| Associate’s degree | 52% |

| Bachelor’s degree | 59% |

| Graduate or professional degree | 68% |

Opening multiple bank accounts in a very short time will lower your credit score temporarily, but in general, credit scores are not affected by the number of bank accounts. Having multiple bank accounts is good for your credit score if you settle the repayments on time, and you do not exceed the overdraft limit. We recommend using the Prillionaires, web-based wealth management software to monitor your accounts in a single place and receive notifications about payments.

Under the Federal Deposit Insurance Corporation (FDIC), your money is protected up to $250,000 in one bank. (the institution, not per account) If you have more savings, it is recommended to spread the money out in different banks.

Planning tools help you track your income, expenses, and savings. They make it easier to set and achieve financial goals by providing insights into your spending habits and highlighting areas where you can save money.

A savings account helps you set aside money for future needs and earn interest. A checking account offers easy access to your funds for daily expenses. A debit card provides a convenient way to make everyday purchases directly from your checking account without incurring debt. Using these accounts together helps manage your cash flow efficiently.

A robo advisor provides automated financial advice and portfolio management through an intuitive interface. It helps you manage your investments and achieve your financial goals efficiently.